What does ‘Regression to the Mean’ mean?

“Regression toward the mean. That is, in any series of random events an extraordinary event is most likely to be followed, due purely to chance, by a more ordinary one.”

What does ‘Regression to the Mean’ refer to?

Back in the 90s, there was talk of something called the Sports Illustrated ‘cover curse’.

It referred to the uncanny frequency of poor runs of performance for stars who had recently graced the magazine’s front page.

Could the two things possibly be related? Did posing for a photo turn a once-talented player into an also-ran?

Of course not.

What was really happening was something statisticians refer to as ‘regression to the mean.’

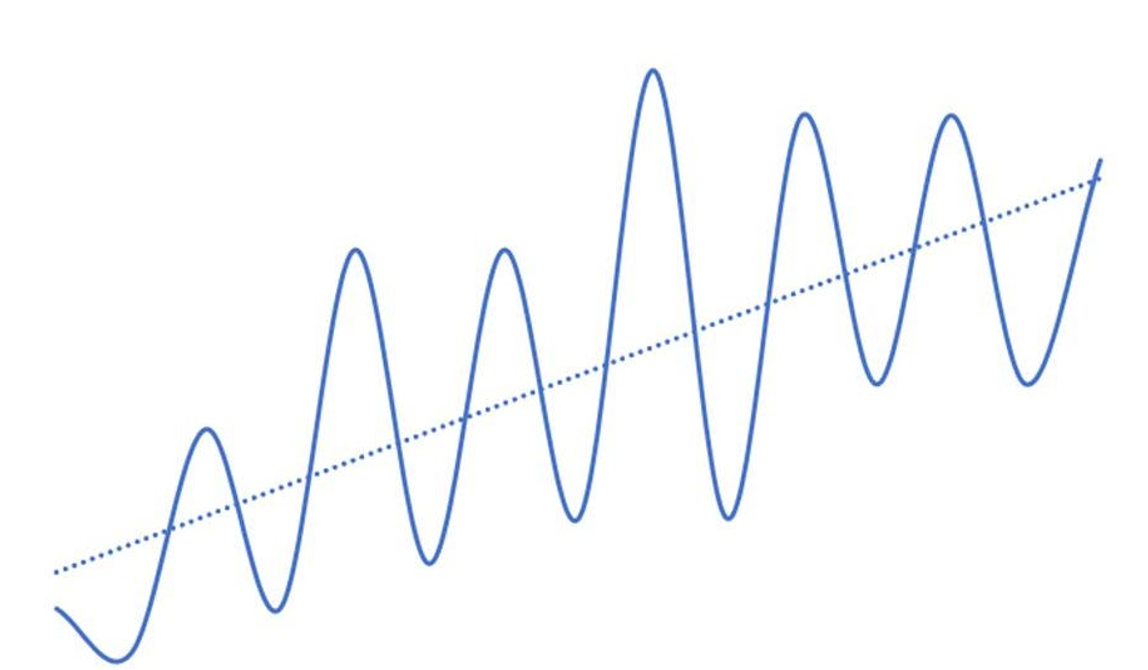

It’s a term used to describe ‘how a random variable that is outside the norm eventually tends to return to the norm.’

Sports Illustrated chose a player to feature as their cover star because that player had recently enjoyed a period of extraordinary performance.

The key word in the previous sentence is ‘extraordinary’ because it was out of the norm; the player eventually returned to their average level of performance.

In other words, a blip in the data is usually just that; things return to their historical average at some point.

Why is it helpful to know about ‘Regression to the Mean’?

It’s human nature to try and make sense of information.

This makes us prone to twisting it to fit the narrative that best suits us.

This tendency leads us to make poor decisions in certain contexts because we ascribe meaning to random events.

Take investing in the stock market, for example.

Suppose the stock you have invested in is doing well.

In that case, you will likely look for information confirming your belief that it will continue to rise (a classic example of confirmation bias).

The impact of this?

You will buy more stock at increasingly elevated prices.

This might not matter if the price continues to rise in the short term.

However, the stock can’t possibly continue on this trajectory forever.

There will be a correction at some point, and the price will return to its historical average.

Continuing with the investment theme, it also explains why it’s dangerous to pick a managed fund based on its past performance.

Very few fund managers can consistently deliver superior performance for a long time.

If a fund has been doing exceptionally well for a few years, it will likely soon experience a downturn.

Or, as the brilliant finance writer Morgan Housel put it, ‘Unsustainable trends tend not to sustain themselves’.

Where can you read more about ‘Regression to the Mean’?

This Farnam Street article is a solid place to start. You might also enjoy this helpful video explanation.

You can read Morgan Housel’s excellent blogs on collaborativefund.com, and his book The Psychology of Money comes highly recommended.