10 Mental Models Worth Knowing

““If you think of your brain as the operating system, mental models are the different apps that you can install to give you functionality and to improve your decision making.””

What are ‘mental models’?

‘Mental models’ are tools or frameworks to improve your ability to think, solve problems and make better decisions.

The term ‘mental models’ was first used by the investing guru Charlie Munger in a famous commencement speech at USC Business School in 1994.

Why are ‘mental models’ useful?

Your brain doesn’t have enough power to process everything at a conscious level.

It would frequently crash like an old computer if it did try to.

Instead, the vast majority of your information processing and decision making occurs subconsciously or ‘below the surface’.

This system works well most of the time, but it leaves you prone to cognitive errors, leading to suboptimal choices.

Mental models help you make fewer ‘unforced errors’ by removing blind spots in your thinking and making you aware of your cognitive biases.

They also allow you to examine problems from multiple viewpoints, giving you an advantage in an increasingly complex world.

How many ‘mental models’ do you need?

There are hundreds of well-known ones, but you can gain an edge from knowing a handful of the key ones from various disciplines, including physics, biology, maths, engineering, etc.

As Charlie Munger put it, “A few big ideas across multiple disciplines carry 95% of the freight”.

Where can you read more about ‘mental models’?

Mental Models: 30 Thinking Tools that Separate the Average From the Exceptional by Peter Hollins and Superthinking: The Big Book of Mental Models by Gabriel Weinberg and Lauren McCann are two fantastic books on this topic.

1. The Pareto Principle

“80% of the results come from 20% of the causes. A few things are important; most are not.”

What is the ‘Pareto principle’?

Sometimes referred to as the 80/20 rule or the ‘law of the vital few’, the Pareto principle is named after the Italian economist Vilfredo Pareto.

Pareto discovered that approximately 20% of the Italian population owned 80% of the land.

Upon further investigation, he noticed that the same ratio appeared to apply to other things.

Therefore, the Pareto principle states that for many outcomes, approximately 80% of consequences come from 20% of causes.

Why is it helpful to know about the ‘Pareto principle’?

The Pareto principle is a great rule of thumb for life.

For example, if you are a business owner, 80% of your revenue is likely to come from 20% of your customers.

If you run a social media account, 80% of your interactions will come from 20% of your followers.

This rule even applies to carpet wear; would you believe it?

The US carpet tile maker Interface discovered that 20 per cent of any carpet receives 80 per cent of the wear.

Where can you read more about the ‘Pareto principle’?

The 80/20 Principle: The Secret of Achieving More with Less by Richard Koch is a good place to start.

2. Compounding

“Play iterated games. All the returns in life, whether in wealth, relationships, or knowledge, come from compound interest.”

What is ‘Compounding’?

How often have you heard the phrase ‘the rich get richer’?

Do you know why?

The answer is to do with something called compounding.

Compounding occurs when small actions add up to something greater than the sum of their parts over time.

For example, if you put £1,000 into a savings account with 10% interest, you will have £1,100 at the end of the first year (the initial ‘principal’ of £1,000 plus £100 in interest).

However, by the end of the second year, you will have £1,210.

This figure comes from the £1,100 from the previous year plus the interest amount of £110 (10% of £1100) added on top.

In the third year, you will have £1,331 (£1,210 plus your 10% interest of £121), and the interest earned continues to compound from there.

At the end of the 10th year, you'll have £2,594 (or more than double your original savings amount), without needing to add any more money after your initial investment.

It’s like magic.

In the beginning, it won’t look like you’re making much progress, but then things start to grow exponentially.

The power of compounding is behind one of the most successful investors of all time Warren Buffet.

Known as the ‘Sage of Omaha’, this shrewd money manager accumulated a staggering 99% of his $100 billion net worth after turning 50!

Why is it helpful to know about ‘Compounding’?

Compounding is more than just the key to building wealth.

Your level of fitness, the strength of your relationships, and your depth of knowledge all benefit from compounding.

Small actions performed consistently over time will ultimately become something of great significance.

It’s helpful to understand how compounding works because your brain tends to think of growth in linear terms and not exponential.

Where can you read more about ‘Compounding’?

The Compound Effect: Jumpstart Your Income, Your Life, Your Success by Darren Hardy is a great place to start. Another fantastic book is The Joys Of Compounding: The Passionate Pursuit of Lifelong Learning by Gautam Baid.

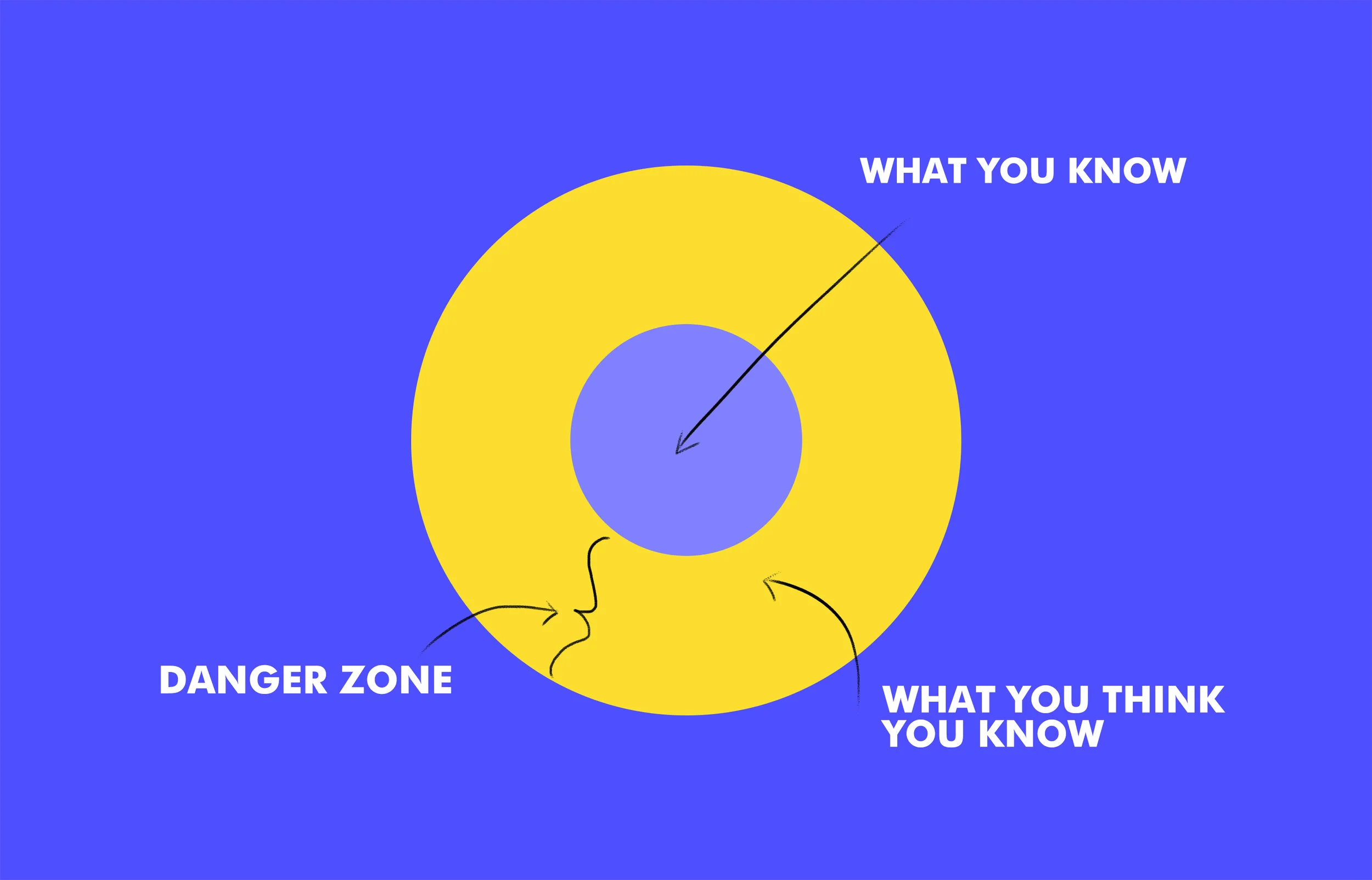

3. Circle of Competence

“Each man is capable of doing one thing well. If he attempts several, he will fail to achieve distinction in any.”

What is the ‘Circle of Competence’?

It would take you over 80,000 years to read all of the material in the British Library.

That’s far more information than anyone could possibly take on board in a lifetime.

It is a mighty humbling fact.

As the august philosopher Aristotle once said, “The more you know, the more you know you don't know.”

So what can you do about it?

The main thing is to stop stressing and realise that not knowing the entirety of the world's information can be an advantage.

You see, we all have our areas of specific knowledge.

They are the product of our unique upbringing, personal interests and career experience.

Warren Buffett, the billionaire investor, argues that it is here that we should ruthlessly focus our efforts.

Buffett first outlined his ‘circle of competence’ concept in one of his shareholder letters, designed to help investors better judge the quality of their investment decisions.

The idea is you don’t have to be an expert on every company. You just need to evaluate those companies within your own 'circle of competence.'

He credits awareness of the limitations of his own knowledge as being fundamental to his extraordinary success.

Why is it useful to know about the ‘Circle of Competence’?

Take a moment to think about how this might apply to your own life.

Be honest with yourself and consider the following questions:

- What exactly is my 'circle of competence'

- How can I use this particular knowledge to improve my position in life?

- What am I currently wasting time on that sits outside my circle?

In summary, if you want to be more successful in life, define the perimeter of your circle and operate inside it.

Where can you learn more about the ‘Circle of Competence’?

This blog post from Farnam Street is a solid place to start.

4. Leverage

“Give me a lever long enough and a place to stand, and I will move the earth.”

What is ‘Leverage?’

Leverage is the use of an existing or borrowed resource to achieve something new or better.

The most common form of leverage is a mortgage which allows you to buy an expensive asset using a bank's money.

Assuming you pay off your mortgage and your house has appreciated, you now have ownership of something you could not have bought otherwise.

Leverage comes in three main forms:

1. People

Businesses make money by leveraging their employees. This is because each staff member generates more revenue than it costs the company in wages. For example, Apple has an income of nearly $2 million per employee but the average estimated annual salary at Apple is only $143,362.

2. Money

Businesses borrow money from banks to expand their operations, and individuals borrow money to buy homes in the form of a mortgage. Assuming the business grows and the home appreciates then the use of leverage has been successful.

3. Technology

Technology helps reduce costs by making it faster and easier to do something. The internet is an excellent example of technological leverage because it allows the creation of a business where the marginal cost is almost zero.

Why is it helpful to know about ‘Leverage?’

To achieve outsized success, you need to employ leverage. This is because there’s only so much you can achieve.

For example, when it comes to earning money, your potential remuneration is limited by the maximum amount you can make hourly.

The only way to increase your earnings beyond this is by employing leverage.

Let’s say you are an experienced widget maker.

After many years of practice, you have worked out how to make 50 widgets a day. 👏

Using your enviable powers of persuasion, you’ve worked out that you can sell each widget for £10 in the local market.

This means the maximum daily revenue you can generate is £500.

However, if you employ a group of five widget makers to help you, your total increases dramatically.

Assuming you pay them each £5 per widget (meaning their total daily wages equal £1,250 as each person receives £250), they will generate £2,500 in revenue.

Minus wages, this leaves you with £750, which is 50% more than you made as an individual, and you didn’t have to make any widgets yourself.

Clever you.

Where can you read more about ‘Leverage?’

Life Leverage: How to Get More Done in Less Time, Outsource Everything & Create Your Ideal Mobile Lifestyle by Rob Moore is well worth reading. It covers applying this principle to money, business, time and more.

5. Framing

“None of us see the world as it is but as we are, as our frames of reference, or maps, define the territory.”

What is ‘Framing’?

James Webb-Young was a successful American advertising executive.

He received many accolades during his career, including the Advertising Man of the Year Award in 1946.

Webb-Young also found time to write one of the most enduring books on the creative process.

When he retired, he bought an apple farm in the mountains of New Mexico.

The orchard was several hundred acres in size, which was more than enough for him to top up his retirement income.

What Webb-Young didn’t realise is that the high altitude meant hailstones would regularly fall and damage the surface of his crop.

Apple merchants weren't interested in selling them as they appeared substandard.

Thinking creatively, he decided to sell the apples at a premium via mail order.

He described the unattractive pits in the apples as ‘dimples’ and used the line ‘Not pitted by hailstones but dimpled by the heavens.’

This was proof of the apples’ high-altitude provenance; he had turned an apparent shortcoming into a unique benefit.

This remarkable story illustrates the concept of ‘framing’.

This is the idea that the same product attribute (in this case, the dents in the apple) can be something desirable or unpleasant, depending on how you frame it.

Why is it helpful to know about ‘Framing’?

Framing gives you the ability to present the same information in different ways.

This is useful depending on the outcome you want.

For example, life insurance used to be called death insurance.

Changing it from ‘death’ to ‘life’ dramatically transformed the takeup of policies despite the only difference being in the name.

Other examples of framing include:

1. A yoghurt could be labelled as ‘90% fat-free’ or, alternatively, as containing ‘10% fat.’

2. ‘XYZ company’s stock showed a slight decrease of 0.1%’ or, alternatively, ‘XYZ company suffered a loss of 10 million from a drop in the share price’, even though the actual numbers are identical.

3. Would you rather buy a condom described as being ‘95% effective’ or having a ‘5% chance of failure’?

Where can you read more about ‘Framing’?

Predictably Irrational: The Hidden Forces That Shape Our Decisions by Dan Ariely and Richard Shotton’s The Choice Factory: 25 Behavioural Biases that Influence what We Buy are worth reading.

6. Via Negativa

“To attain knowledge, add things every day. To attain wisdom, subtract things every day.”

What does ‘Via Negativa’ mean?

The author Nassim Taleb describes this Latin phrase which comes from Christian theology, as follows:

“Via negativa: In theology and philosophy, the focus on what something is not, an indirect definition. In action, it is a recipe for what to avoid, what not to do—subtraction, not addition, say, in medicine.”

In other words, it is easier to better your life by subtracting the things that negatively impact it as opposed to adding something that positively impacts it.

Why is applying ‘Via Negativa’ to your life helpful?

You can dramatically improve your life simply by removing things.

Take the news, for example.

You can radically boost your happiness levels by not watching or reading any.

Improving your diet is another example.

Rather than only eating healthy items, you can simply eat fewer unhealthy ones.

In other words, instead of going to the effort of cooking vegetable couscous, you can just say no doughnuts.

Where can you read more about ‘Via Negativa?’

This helpful principle is discussed at length in the brilliant book Antifragile: Things that Gain from Disorder by Nassim Nicholas Taleb.

7. Friction

“The only things that evolve by themselves in an organization are disorder, friction and malperformance.”

What is ‘Friction?’

Human beings like to take the path of least resistance.

This is because we evolved in a scarce environment where we couldn’t afford to waste energy.

Therefore, you need to reduce the effort involved if you want to encourage certain behaviour.

This explains why the apps you use most often are also the easiest to use, and Amazon.com uses technology like ‘swipe to pay’ to make buying things as ‘frictionless’ as possible.

Why is it helpful to know about ‘Friction?’

To improve your life, think of ways to reduce or add friction.

For example, you are more likely to exercise in the morning if you lay your workout clothes by your bed the night before.

And if you want to eat more fruit, simply put a bowl full of it on your kitchen counter.

Conversely, if you want to do less of something, make it harder (add friction) to do.

An extreme example from the world of personal finance is putting your credit card in a bowl of water and storing it in the freezer.

It’s tough to spend money on it if it’s inside a block of ice!

Where can you read more about ‘Friction?’

Friction: The Untapped Force That Can Be Your Most Powerful Advantage by Roger Dooley is a good book to learn more about this topic.

8. Optionality

“An option is what makes you antifragile and allows you to benefit from the positive side of uncertainty, without a corresponding serious harm from the negative side.”

What is ‘Optionality’?

‘Optionality’ is a term from finance that means the right to take action, but not the obligation.

In other words, you have the choice to do something, but you don’t have to do it.

An attractive option has a fixed downside (i.e. a limited negative impact) and a potentially unlimited upside (i.e. an unbounded positive outcome).

For example, starting your own business could give you financial freedom if it goes well, and if it goes belly up, you haven’t lost much (assuming you haven’t used all your life savings).

Of course, there is such a thing as negative optionality, e.g. a meth habit or being in significant debt.

Why is it helpful to know about ‘Optionality?’

Having no options is uncomfortable as it means you have to put up with whatever your circumstances are.

Understanding the power of optionality means you can identify and take advantage of opportunities with a high probability of positive outcomes.

But don’t go crazy.

Your goal is to create a good calibre of options instead of keeping as many doors open as possible.

In other words, it’s less about the quantity and more about the quality.

Where can you read more about ‘Optionality?’

Optionality: How to Survive and Thrive in a Volatile World by Richard Meadows is an easy-to-read book that will help you better understand this valuable principle.

9. The ‘5 Whys’ Technique

“If you are unable to understand the cause of a problem it is impossible to solve it.”

What is the ‘5 Whys’ Technique?

How often have you heard an endless line of questioning from a child?

Why is the sky blue? Why is water wet? Why can’t we see in the dark?

Children are masters of asking questions which makes them highly effective learners.

It’s also an important strategy for solving problems.

The ‘5 whys’ technique is part of the Toyota Production System designed to reduce mistakes on the automotive assembly line.

It’s as simple as asking five consecutive whys, like in the following example:

Q1. Why was the child late for school?

A. Because they missed the bus.

Q2. Why did they miss the bus?

A. Because they left the house late.

Q3. Why didn’t they leave the house on time?

A. Because they ate breakfast late.

Q4. Why did they eat breakfast late?

A. Because they got up late.

Q5. Why did they get up late?

A. Because they didn’t go to bed on time. (The root cause)

Why is it helpful to know about the ‘5 Whys’ Technique?

One of the most common mistakes when solving problems is failing to address the root cause.

This means that the problem isn’t adequately addressed and can even be made worse.

The ‘5 Whys’ is an exercise to avoid this trap because it helps you get to the root cause.

Ultimately, this prevents you from wasting time and resources trying to solve the wrong thing.

Where can you read more about the ‘5 Whys’ Technique?

This article is a helpful place to begin.

10. Reversible vs Irreversible Decisions

“Sometimes you make the right decision, sometimes you make the decision right. ”

What’s the difference between a ‘reversible' and an ‘irreversible’ decision?

When Jeff Bezos was on the verge of starting Amazon.com, he had an epiphany.

He realised that certain decisions carry more weight than others.

Whilst most choices are easy to reverse, an ‘irreversible’ decision is one it is extremely difficult or impossible to back out of.

For example, choosing to have a child.

Why is it helpful to know about ‘reversible' and ‘irreversible’ decisions?

We tend to spend too much time on the inconsequential decisions and not enough on those that really matter.

For example, we might devote more time planning our summer holidays than making important decisions about our financial future.

Asking yourself whether a decision is reversible or not helps you make faster decisions because you don’t waste time deliberating over issues that you can easily overcome.

This frees up the mental capacity to spend more time thinking about the decisions that have lasting consequences.

Where can I read more about ‘reversible' and ‘irreversible’ decisions?

Again, our friends at Farnam Street come to the rescue with this handy post.

If you found this post helpful, you might enjoy one of our courses. Why not take a moment to browse what’s on offer at 42courses.com?